The Canada Revenue Agency (CRA) offers tax-free quarterly payments known as the Goods and Services Tax/Harmonized Sales Tax (GST/HST) Credit to assist individuals and families in partially offsetting the GST or HST that they are required to pay. A thorough overview of the GST/HST credit is given in this page, along with important details about qualifying requirements, Canada GST HST Credit Dates 2024 and application procedures. It is to inform you that the Canada GST HST Credit Eligibility 2024 is required to be checked by beneficiaries in order to claim the benefits.

Canada GST HST Credit 2024

The GST/HST credit is a government program offered to households with low to moderate incomes in Canada. The aim of the benefit is to help lower- income families in Canada pay for the expenses associated with sales taxes. The Canada GST HST Credit 2024, which is a tax free quarterly payment provided to low-income singles and families, can assist them. Their annual GST or HST payment is supposed to balance the credit.

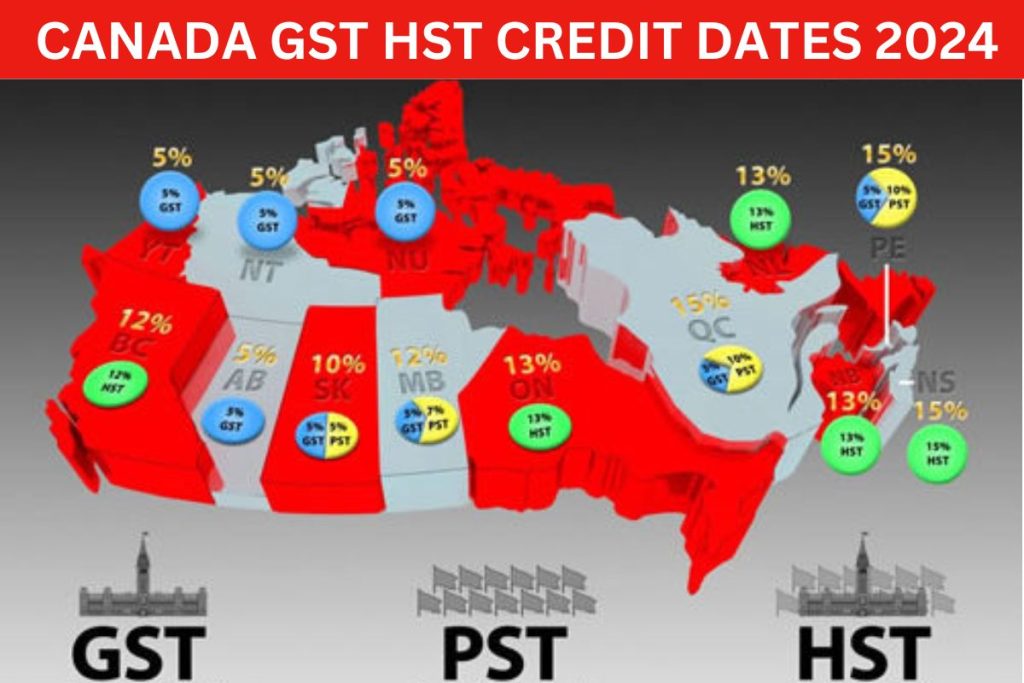

Depending on where you live in Canada, you will be charged for one or the other. For instance, Ontario has the HST while Alberta has the GST. The rates and taxable supplies are governed at the provincial level. Most of the products and services we purchase on a daily basis are subject to sales taxes, which inexorably drives up the cost of living.

We advise you to read our another post Ontario Hourly Wage Increase 2024.

Canada GST HST Credit Dates 2024

| Title | Canada GST/HST Credit 2024 |

| Country | Canada |

| Department | Canada Revenue Agency |

| Year | 2024 |

| Category | Finance News |

| Canada GST HST Credit Dates 2024 | January 5th, April 5, 2024, July 5th, October 4th |

| Category | Finance |

| Official Website | www.canada.ca |

Canada GST HST Credit Payment Dates 2024

Four times a year, the CRA pays the GST/HST credit. The Canada GST HST Credit Payment Dates 2024 are:

- January, 5th 2024

- April, 5th 2024 – July, 5th 2024

- October, 4th 2024

After the appointed dates, you should receive your payment within 10 business days. Your family’s net income and makeup will determine how much you will get. While some receivers still receive paper checks in the mail, the majority of recipients get paid by direct deposit. In order to receive your payment on schedule, make sure the CRA has the most recent version of your banking information.

Canada GST HST Credit Eligibility 2024

The requirements to be eligible for the GST/HST credit are not very complicated. Kindly check the Canada GST HST Credit Eligibility 2024 in the following points.

- To become eligible for that you have to be a resident of Canada and at least 19 years old.

- The applicant is married or has a common- law partner, and/or

- The applicant is a parent or has been a parent.

Your prior year’s tax return is used to calculate your eligibility. Thus, your eligibility for GST/HST credit payments in 2024 is determined by your tax return from 2023.

Procedure To Claim Canada GST HST Credit 2024

The process to Claim Canada GST HST Credit 2024 is very simple. The CRA will automatically identify your eligibility and distribute payments; all you have to do is complete your annual tax return.

- You must complete Form RC151, GST/HST Credit Application for individuals who become Residents of Canada, as a new resident. After reviewing your application, the CRA will enroll you for the payments if it is authorised.

- To ensure that your children are taken into account when calculating your payment amount, make sure to list them as dependents on your tax returns.

- If you get married, have a new child, or separate from someone, let the CRA know so that your benefits can be modified appropriately.

FAQs On Canada GST HST Credit Dates 2024

GST/HST Credit, which is a tax-free quarterly payment given by the Canadian government to families and people with low to moderate incomes to help them balance a portion of the GST/HST they must pay.

An explanation of how the number of children, marital status, and individual or family income are used to calculate the GST/HST Credit amount.

An explanation of any reporting obligations for tax purposes as well as whether the GST/HST Credit is regarded as taxable income.

Payments for the GST/HST credit are normally made on the fifth day of July, October, January, and April, if not earlier. If, on the GST/HST due dates, you haven’t gotten your benefit yet, give yourself up to 10 working days before contacting CRA.